Review on Avatrade

An In-Depth Overview of AvaTrade

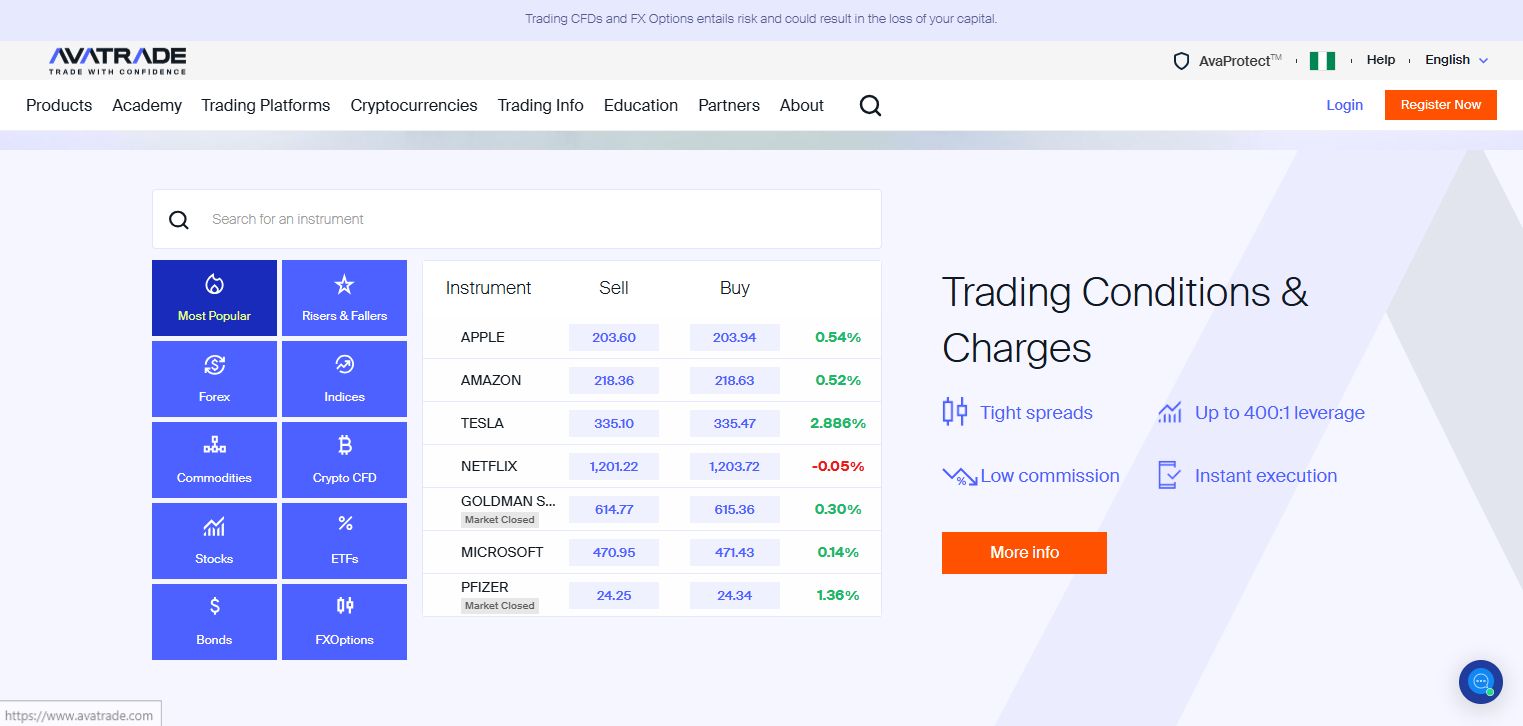

AvaTrade presents itself as a globally recognized broker offering services in forex, cryptocurrencies, CFDs, stocks, commodities, and more. Established in the mid-2000s, it has expanded to serve traders from different parts of the world through its range of trading platforms like MetaTrader 4, MetaTrader 5, and proprietary mobile/web-based systems.

The site claims to provide a secure, regulated environment for traders with strong emphasis on user education and risk management tools. Its marketing heavily promotes ease of use, high leverage options, zero commissions, and access to a wide range of markets.

Despite these claims, a closer analysis reveals inconsistencies and unresolved complaints, particularly around withdrawal issues, delayed customer service, and questionable marketing practices. Many users also report that the promises of fast withdrawals and responsive support do not align with their actual experience.

This raises the critical question: is AvaTrade a legitimate broker, or is it another broker that hides behind regulation while engaging in unethical practices?

Notable Keypoints to note on avatrade

High volume of unresolved withdrawal complaints

Aggressive deposit solicitation by account managers

Regulatory status does not ensure safe trading practices

Opaque bonus and fee structures

Comprehensive Breakdown of AvaTrade’s Credibility and Operations

AvaTrade operates in the financial trading space with a primary focus on offering access to various global markets, including cryptocurrencies, forex, stocks, indices, and commodities. On the surface, it presents itself as a modern and well-established broker, boasting numerous trading tools and platforms, including popular interfaces like MetaTrader and proprietary mobile platforms. For potential traders, this wide accessibility appears to reflect reliability and transparency. However, once you delve into the finer details of how the company functions, numerous concerns begin to surface especially when it comes to the actual experience users report versus the polished image promoted by the platform.

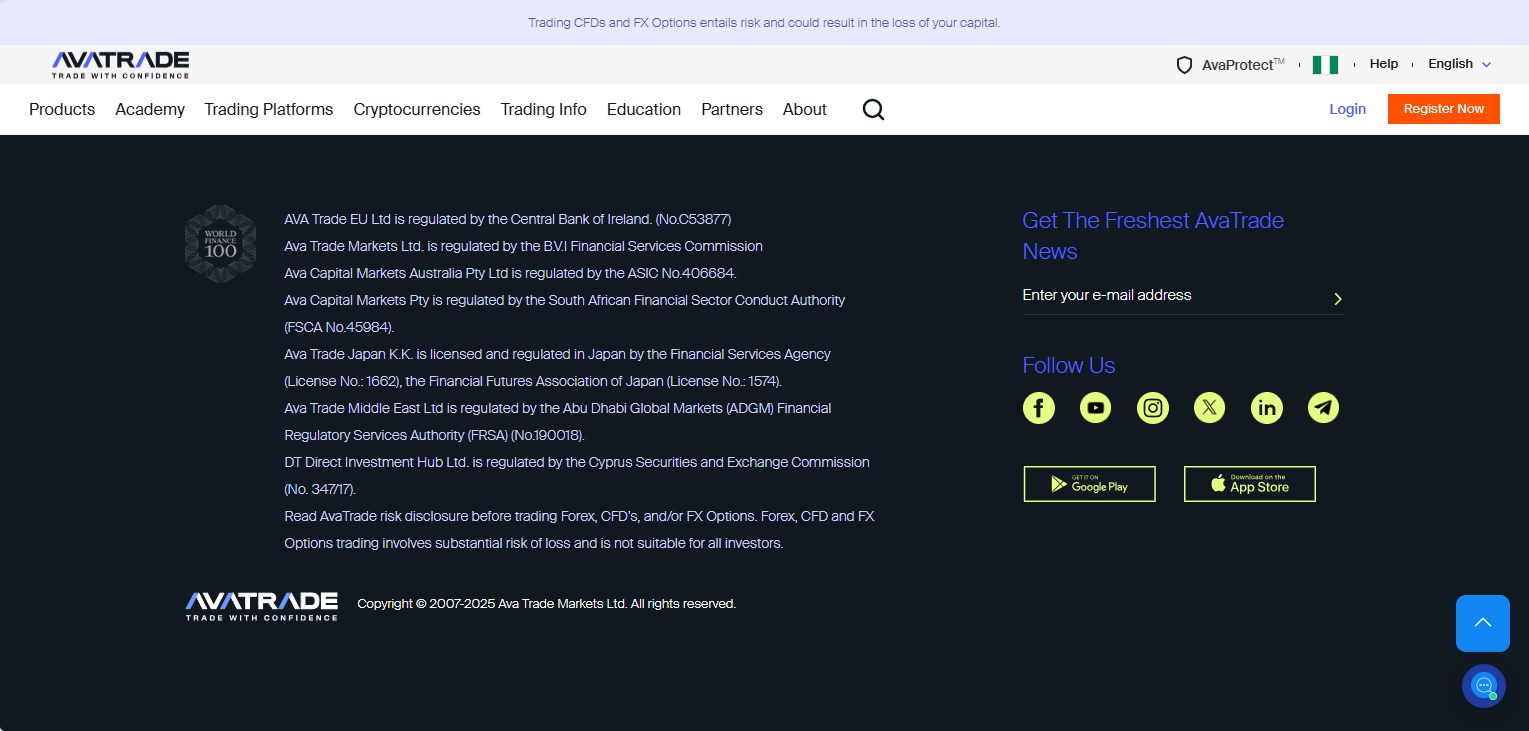

The first area of concern lies in AvaTrade's claims of being a highly regulated entity. Although the company does operate under various licenses, regulation does not always equate to ethical operations. A regulatory license may legally allow a company to provide financial services, but it does not necessarily guarantee that the company will always act in the best interest of its clients. Regulation also tends to vary significantly across jurisdictions, and some authorities have limited oversight or slower enforcement processes. This means a broker can operate under regulation and still engage in aggressive or questionable business practices without immediate consequences. The presence of a license should not automatically be interpreted as a seal of integrity.

Another key issue often raised by users revolves around withdrawal processes. Many customers have experienced prolonged delays when attempting to retrieve their funds from AvaTrade. In some cases, users claim that their withdrawal requests were rejected or stalled without clear explanations. Others report being asked to submit additional documents repeatedly, even after meeting the initial verification requirements. Such practices create unnecessary obstacles and contribute to the perception that the platform may be actively discouraging or delaying fund access. While some delays in financial transactions are expected due to compliance procedures, the consistency and severity of the complaints suggest that this issue is more systemic than occasional.

In addition to withdrawal challenges, the company’s approach to account management raises red flags. Traders have frequently reported being contacted by representatives who urge them to increase their deposits, often with promises of better market opportunities or customized support. This high-pressure tactic resembles those used by less reputable brokers and is concerning for any trader especially beginners who may be susceptible to persuasion. Encouraging users to invest more without proper financial advisement creates a conflict of interest and suggests that the broker may prioritize its profit margins over the client’s long-term success or safety.

Furthermore, the platform’s terms and conditions contain language that is vague and potentially detrimental to clients. For example, clauses related to account inactivity, bonus usage, and margin requirements are not always clearly defined. In practice, this means that AvaTrade reserves the right to impose fees or cancel trading bonuses under terms that might not be fully understood by the average user. Ambiguities in legal documents are often exploited in scenarios where users challenge a broker’s decisions or seek resolution during disputes. This creates an uneven power dynamic where the trader is left vulnerable, particularly if they are unaware of the exact terms they agreed to upon registration.

Another concern is the reliability of the trading environment itself. While AvaTrade advertises competitive spreads and robust trading execution, some users have reported significant slippage and platform freezes during high market volatility. These conditions can be detrimental to traders, especially those using short-term strategies like scalping or day trading. When a platform performs poorly during critical market moments, it can lead to substantial losses that may otherwise have been avoidable. Inconsistent execution erodes trust in the platform’s infrastructure and suggests that advertised technical performance may not match reality.

Lastly, while AvaTrade claims to offer multilingual customer support and dedicated service teams, the actual user experience often contradicts these assertions. Support requests, particularly those related to fund withdrawals or account restrictions, are often met with slow responses or unhelpful template replies. This lack of proactive and efficient customer care contributes to user frustration and further amplifies doubts about the broker’s commitment to its clients. For a financial service provider, dependable support is not just a bonus it is essential for maintaining credibility and ensuring clients feel protected.

In summary, AvaTrade promotes itself as a comprehensive and regulated brokerage platform, but multiple factors suggest that traders should approach it with caution. From inconsistent withdrawal policies and high-pressure sales tactics to vague terms and customer support challenges, the platform displays behaviors that are often associated with predatory brokers. While it may technically operate within legal boundaries, the ethical and practical implications of its operations warrant serious scrutiny. For new and experienced traders alike, transparency, fund security, and support responsiveness are critical and unfortunately, AvaTrade does not consistently meet expectations in these key areas.