Review on Equitiglobalmarket

Equity Global Market presents itself as a groundbreaking cryptocurrency investment and mining platform, committed to innovation, transparency, and outstanding returns. The website showcases inspiring messaging that encourages investors to create wealth, utilizing advanced tools and exploring mining opportunities. Nonetheless, it is deficient in transparent regulatory credentials, a verifiable corporate identity, or substantial information regarding its operations. No physical or legal address, licensing information, or clarity regarding returns, mining infrastructure, or audit processes is provided. The absence of these elements brings forth significant doubts regarding the authenticity of the offering.

Notable Keypoints to note on equitiglobalmarket

There is no oversight from a licensed registration or regulatory authority.

Ambiguous "about us" wording lacking a clear team structure or qualifications.

No physical or legal contact address is displayed on the site.

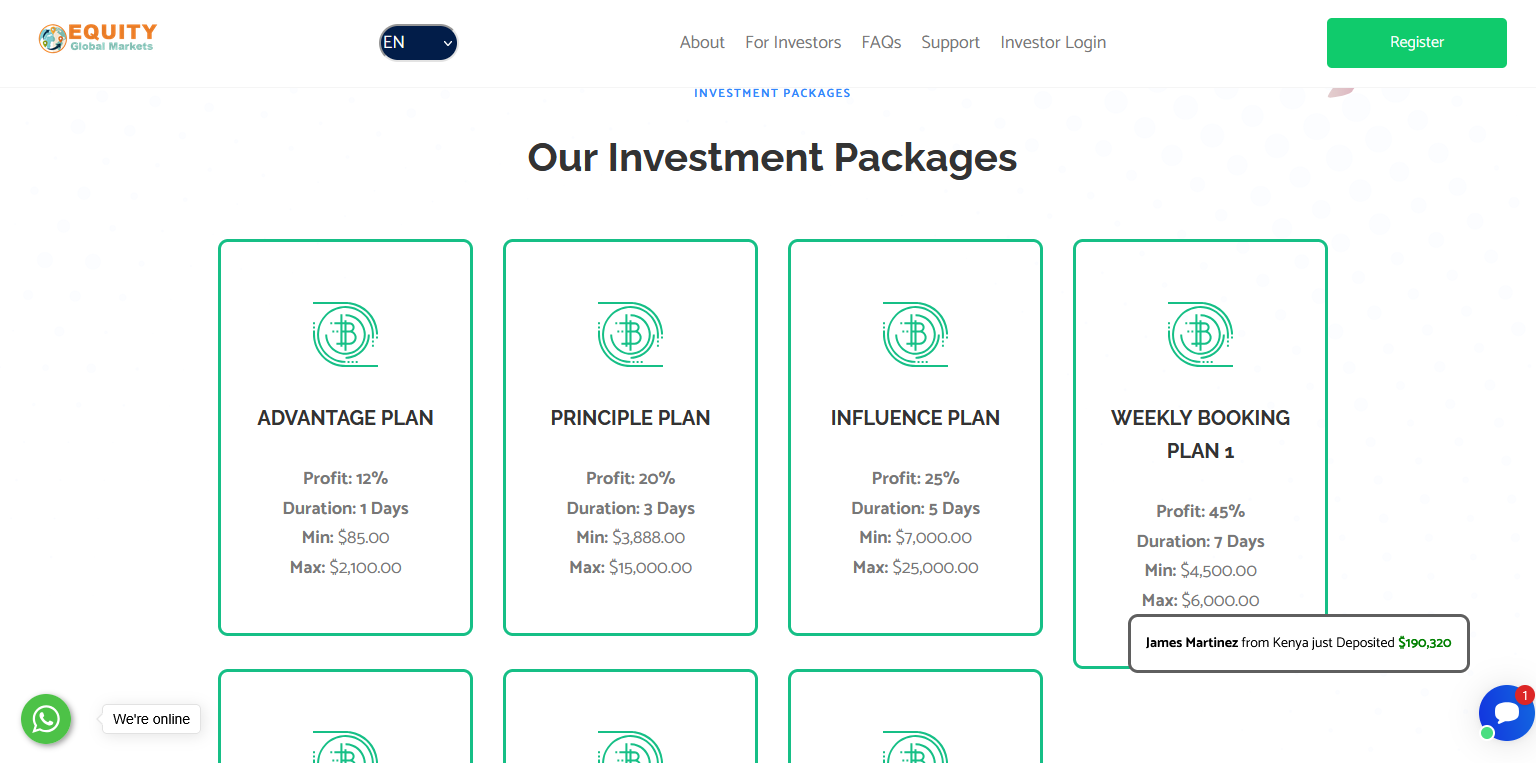

Unrealistic profit claims lacking any numerical evidence.

An In-Depth Analysis of Why This Site May Be a Scam

This website showcases a significant array of warning signs that, when closely analyzed, clearly indicate it is probably a scam operation aimed at deceiving unsuspecting individuals. The entire approach, from its assertions to its absence of transparency, aligns seamlessly with recognized patterns of cryptocurrency and online investment fraud.

Lack of Regulatory Oversight

The most critical and concerning warning sign is the platform's total lack of regulatory oversight. Reputable crypto investment platforms, particularly those managing substantial user funds and providing intricate financial services, are required by law and ethical standards to be regulated or at the very least registered with leading financial authorities in the regions where they function. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC) are established specifically to safeguard investors, maintain market integrity, and uphold rigorous compliance standards. Nonetheless, this site lacks any verifiable credentials there are no license numbers available, no specific regulatory bodies identified for independent verification, and no clear information regarding jurisdiction. Independent analysis groups and financial watchdogs regularly highlight these platforms as unregulated and unreliable for this precise reason. The significant absence of accountability results in investors functioning without legal safeguards, leaving them without options in cases of platform failure, misconduct, or outright theft, rendering any deposited funds highly susceptible.

Concerning Lack of Clarity in Ownership and Infrastructure

The regulatory void is further exacerbated by a concerning lack of transparency regarding ownership and infrastructure. A credible financial services firm, no matter its area of specialization, offers clear and transparent details regarding its corporate identity. This encompasses a verifiable corporate address, information regarding its board of directors or key management team, and independently audited financial statements. This website, on the other hand, provides none of these essential details. The parties involved in the operation are entirely unidentified, rendering it unfeasible for prospective investors to perform thorough checks on their history, expertise, or trustworthiness. Reliable registries and professional evaluations indicate that this level of anonymity and lack of transparency is characteristic of fraudulent activities. By hiding its genuine identity and operational framework, the platform deliberately obstructs any possibility of accountability, facilitating the ability of offenders to vanish without a trace after securing adequate funds.

Unsubstantiated Performance Assertions and Promotional Exaggerations

The assertions presented on the website concerning investment returns and operational success are merely unsubstantiated performance claims disguised as credible opportunities. The website employs vague marketing language like "unparalleled opportunities" and "profitable crypto mining ventures" to attract users. Nonetheless, these are lofty claims lacking in meaningful content. There is an absence of verifiable past performance records, no tangible trading results, and no clear proof-of-work infrastructure to support its claimed crypto mining activities. Genuine crypto mining endeavors necessitate considerable energy, hardware, and credible evidence of their mining pools and results. In the absence of audited reports, clear historical data, or proof of real operational capability, these assertions remain nothing more than speculative promises aimed at enticing unwary investors. The dependence on ambiguous, unsupported marketing instead of solid, confirmable data serves as a clear sign of a misleading operation.

Remarkable resemblance to familiar scam tactics

The overall framework and assurances of this platform closely resemble many familiar scam operations that have deceived millions around the world. Offering assured crypto returns and mining profits without genuine transparency or verifiable underlying assets is a typical trend. This reflects the operational patterns of infamous schemes such as OneCoin, USI-Tech, and Mirror Trading International, all of which faced dramatic failures after initially drawing in large amounts of capital by promising unrealistic returns. These historical scams consistently concluded with users being denied withdrawals or the platforms disappearing altogether, resulting in complete losses for investors. The ongoing recurrence of this deceptive model on the current website acts as a significant red flag, indicating it is merely another version of a familiar scam strategy.

Clear Advisories from Reputation Specialists

The evaluation of this website's legitimacy is reinforced by clear warnings from industry watchdogs and reputation experts. Independent analysis groups and consumer protection organizations diligently observe and assess these platforms, frequently pinpointing and highlighting those that display questionable traits. These experts clearly caution against this specific platform, highlighting its essential absence of regulation and advising users to opt for regulated brokers instead. The professional consensus, along with the significant lack of oversight, anonymity, unrealistic promises, and the site's structural similarities to recognized scams, strongly and clearly indicates a probable scam operation aimed at extracting money from unsuspecting users under false pretenses.