Review on Orbiscapitals

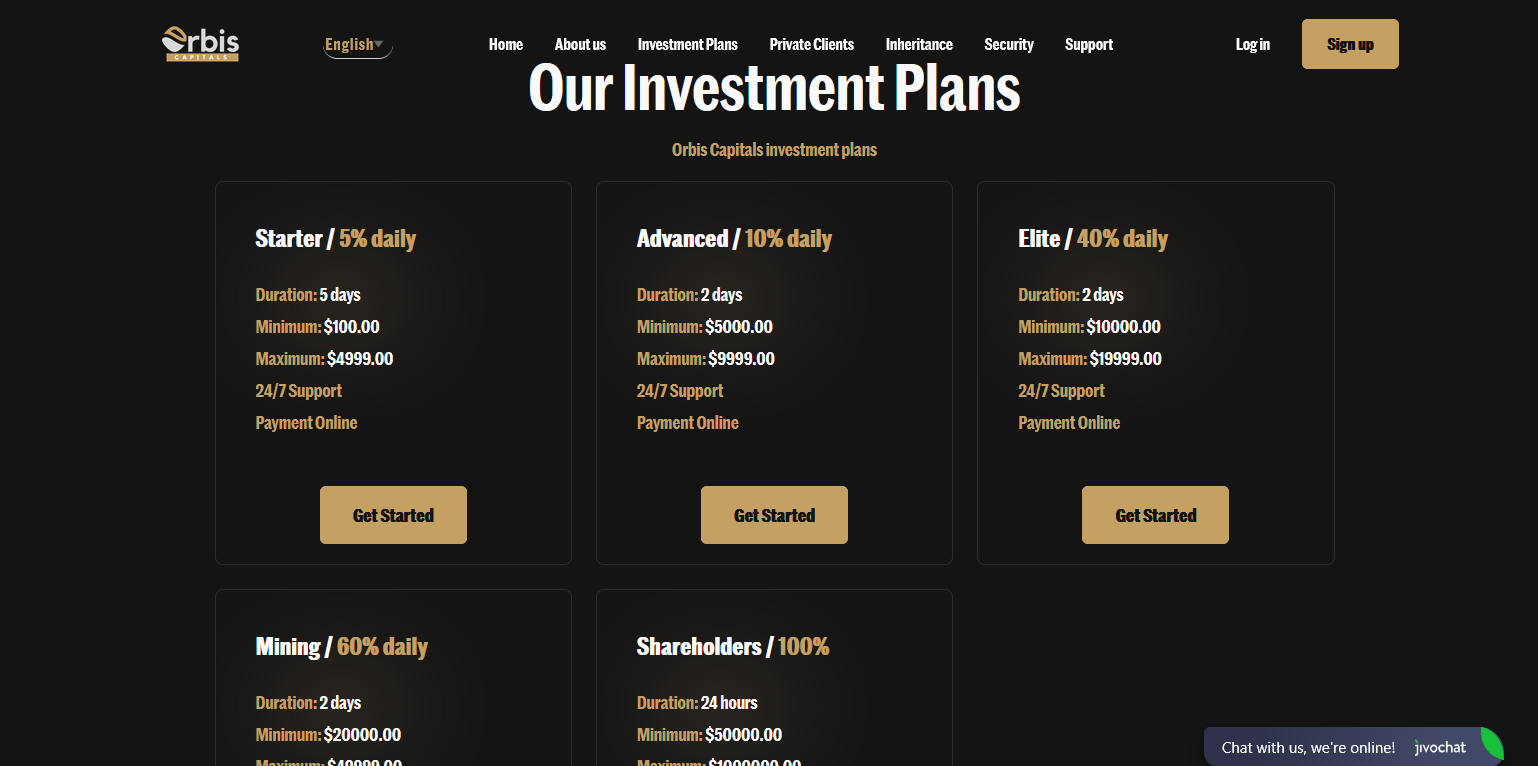

Orbis Capitals describes itself as an investment platform that aims to make investment opportunities available to everyone, using a technology-focused approach. It offers daily investment plans that promise high returns and advertises itself using phrases such as "licensed in New Zealand," "multisig cold storage," "100% full reserve custody," and "zero recurring fees." The website looks really professional and has different investment tiers that provide daily returns between 5% and 100%.

Even though this presentation looks good for investors at first glance, a closer look brings up some serious issues. The platform doesn't clearly show who owns it, whether it meets regulations, how it handles finances, or if there are independent audits in place. There are a few concerning signs like unrealistic profit claims, unknown ownership, and a very recent domain registration that indicate Orbis Capitals might be a high-yield investment program (HYIP) scam instead of a genuine financial service provider.

Notable Keypoints to note on orbiscapitals

The lack of annual reports, independent audits, or financial statements is really strange for an investment firm.

Lack of Team Transparency: There's no clarity on who owns, runs, or manages the platform.

Unrealistic Returns: Claiming daily profits of over 40% goes against all investment principles and is a common sign of financial scams.

Crypto-Only Withdrawals: Using only crypto for deposits and payouts is often a way to avoid financial scrutiny and not leave any paper trail.

Orbis Capitals shows a lot of worrying signs that, when looked at closely, point to many serious red flags suggesting it’s more of a scam than a real investment platform. The mix of unrealistic promises, a clear lack of transparency, and sticking to known fraudulent structures makes it really risky for anyone thinking about investing.

Unrealistic and Unfeasible Return Rates

The most concerning and obvious warning sign for Orbis Capitals is its unrealistic and financially unfeasible return rates. The platform confidently states that it can provide daily profits between 5% and an impressive 100%. Those promises seem really questionable; they go against everything we know about proper financial investment and how the market actually works. No legal institution or regulated entity can truly promise such huge profits in any market be it traditional finance, cryptocurrency, or any other asset class without taking on extremely high and dangerous levels of risk. These rates really show the signs of a Ponzi scheme or something like it, where the first investors get paid using the money from later investors. This creates a false sense of profit that eventually falls apart when new money stops coming in. This misleading bait is created just to attract unsuspecting individuals into putting in their money.

Hidden Ownership and Unnamed Management

Orbis Capitals shows a significant and troubling lack of clarity about who owns and manages it. It's really important for trust and accountability in finance to have clear information about who is in charge of the company. Trustworthy investment platforms always provide information about company directors, important team members, their work histories, and the legal entities in charge of operations, along with their physical addresses. This platform, though, lacks that important transparency. The people or organization behind Orbis Capitals are totally unknown, which makes it really hard for potential investors to check their qualifications, experience, or ethical reputation. The intentional hiding of identity is a common feature of scams, as it helps the scammers avoid being held responsible and makes it harder to track them down when the scheme eventually fails or money is stolen.

Licensing claims that are questionable and hard to verify

Even though it says so, Orbis Capital's claims about licensing seem really questionable and can't be verified at all. The website mentions that it is licensed in New Zealand, which has a recognized financial regulatory authority (the Financial Markets Authority - FMA). However, Orbis Capitals doesn't mention any specific regulatory body, lacks a verifiable license number, and doesn't provide a link to any official verification system on the FMA's register (fsp-register.companiesoffice.govt.nz). Legitimate and regulated companies have to show these credentials clearly and ensure that the public can easily verify them. Claims about licensing that lack any solid or independently verifiable documentation are a big warning sign. They suggest that there might be some made-up information intended to give a false impression of legitimacy and security. The absence of verifiable regulatory status indicates that investors are working without any legal protection or options for recourse.

Confusing Language and False Authority

Orbis Capital tries to seem sophisticated and secure by using confusing language. Terms such as “multisig cold wallet” and “full reserve custody” are mentioned, which might seem really secure and sophisticated to someone who isn’t familiar with them. But, I can't confirm these features on the site. It seems like there isn't a clear audit of the reserves, the multisignature process isn't explained well, and there's no proof of any third-party security certifications. This type of complex technical language is often used to create a misleading impression of credibility and expertise, especially for those who might not be very tech-savvy or aware of the details regarding secure crypto storage. This approach is meant to hide the real issues with proper infrastructure and how things are actually running.

No customer testimonials or external validation present

A major concern for Orbis Capitals is the lack of credible customer testimonials or any external validation. There aren't any verified customer reviews on independent platforms, no mentions in well-known financial news outlets, and no evaluations or awards from recognized industry bodies. This investment platform, particularly one that promises such high returns, raises serious concerns due to the absence of social proof. Real businesses grow through good word-of-mouth, honest client reviews, and acknowledgment in their field. The lack of engagement suggests that the platform might be really new, which goes against any idea of it being established, or it could be hiding something because it can't handle real examination or doesn't have any happy clients to show off.

Classic High-Yield Investment Program (HYIP) Structure

The overall structure of Orbis Capitals' investment options really seems to align with what you would expect from a High-Yield Investment Program (HYIP) scam. This involves different levels of investment options and a clear guarantee of quick wealth creation that isn't realistically feasible. HYIP schemes draw in early investors by promising incredibly high profits, sometimes on a daily basis. The "profits" are paid out with money from new investors, which creates a misleading cycle that makes early participants think their investment is successful. This model keeps going as long as there's a steady influx of new money. Eventually, the number of new investors decreases, the payouts can’t be maintained, and the whole system falls apart, resulting in most later investors facing major or complete losses. Orbis Capital's structure really shows how this kind of fraudulent and unsustainable financial pyramid works.