Review on Solacetrade

SolaceTrade.com positions itself as a leading digital asset investment platform, regulated by the SEC and FINRA, providing services in asset management, investment banking, and securities trading. Nonetheless, independent investigations show that there is no documentation of SEC or FINRA licensing linked to this name. Industry-focused watchdogs categorize similar “Solace” brokers as unregulated entities, potentially based offshore, and likely to be scams. General site-assessment tools can also evoke concern: shared hosting, unfavorable reputation scores, and low rankings suggesting a restricted, potentially deceptive, online presence. Even with refined marketing efforts, more thorough investigations reveal concerning issues that compromise trustworthiness.

Notable Keypoints to note on solacetrade

Bare-faced regulatory claims with zero verifiable documentation.

Warnings from broker-safety experts against investing with them.

A legitimate U.S. investment firm would not typically be absent from SEC/FINRA registers.

Shared hosting often involves a common scam tactic associated with suspicious sites.

This platform showcases a concerning combination of warning signs, clearly suggesting a fraudulent scheme rather than a genuine financial service. The primary and most critical issue is the lack of official listing or regulation by the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). In the United States, any organization involved in the offering and selling of securities to the public, or in providing investment advice, is required to register with the SEC and, for broker-dealers, must also be a member of FINRA. This registration serves as a fundamental element of investor protection, guaranteeing compliance with strict financial, ethical, and operational standards. The absence of oversight results in no regulatory body examining the platform's actions, no options for investors in the event of wrongdoing, and no guarantee that it functions with integrity or has the required capital to protect client funds. This omission is a significant and conclusive failure.

The regulatory shortcomings are exacerbated by a plethora of unfavorable independent reviews, broker safety service evaluations, and user grievances. A reputable financial institution flourishes through a solid reputation established by positive client interactions and clear operations. On the other hand, a flood of complaints, from inadequate service to serious accusations of fraud, indicates a fundamental issue. User testimonials frequently highlight challenges related to account access, lack of responsiveness from customer support, or questionable trading activity, acting as a significant cautionary note. The convergence of various independent sources highlighting these negative experiences creates a vivid illustration of a platform that is not meeting the needs of its users and may even be misleading them.

Technical issues further diminish the platform's credibility. The sharing of hosting with flagged or suspicious websites raises immediate concerns regarding its potential association with illicit activities. Reputable financial services prioritize significant investment in strong, secure, and specialized hosting infrastructure to safeguard sensitive client information and uphold operational integrity. Shared hosting that includes dubious sites indicates a deficiency in professional standards and a heightened risk of security vulnerabilities or connections to fraudulent networks. Furthermore, a low site rating, frequently arising from problems such as expired security certificates, non-functional links, or insufficient transparency in its online presence, strengthens the impression of an unprofessional and possibly unsafe atmosphere. The technical deficiencies present are not trivial oversights; they serve as substantial indicators of a platform that places cost-cutting above security and reliability, which poses a serious risk for financial transactions.

The absence of clarity concerning fees and ownership serves as another significant red flag. Reputable financial firms are required by law and ethical standards to offer transparent, straightforward, and readily available information regarding their leadership team, corporate structure, and all related fees. This enables investors to comprehend the individuals they are engaging with, their credentials, and the expenses linked to their investments. The lack of dependable disclosure implies a desire to conceal information, possibly to evade responsibility or mask a misleading business model. Concealed charges can diminish investment gains, and an unidentifiable leadership group hinders the ability to perform due diligence or pursue remedies when problems occur.

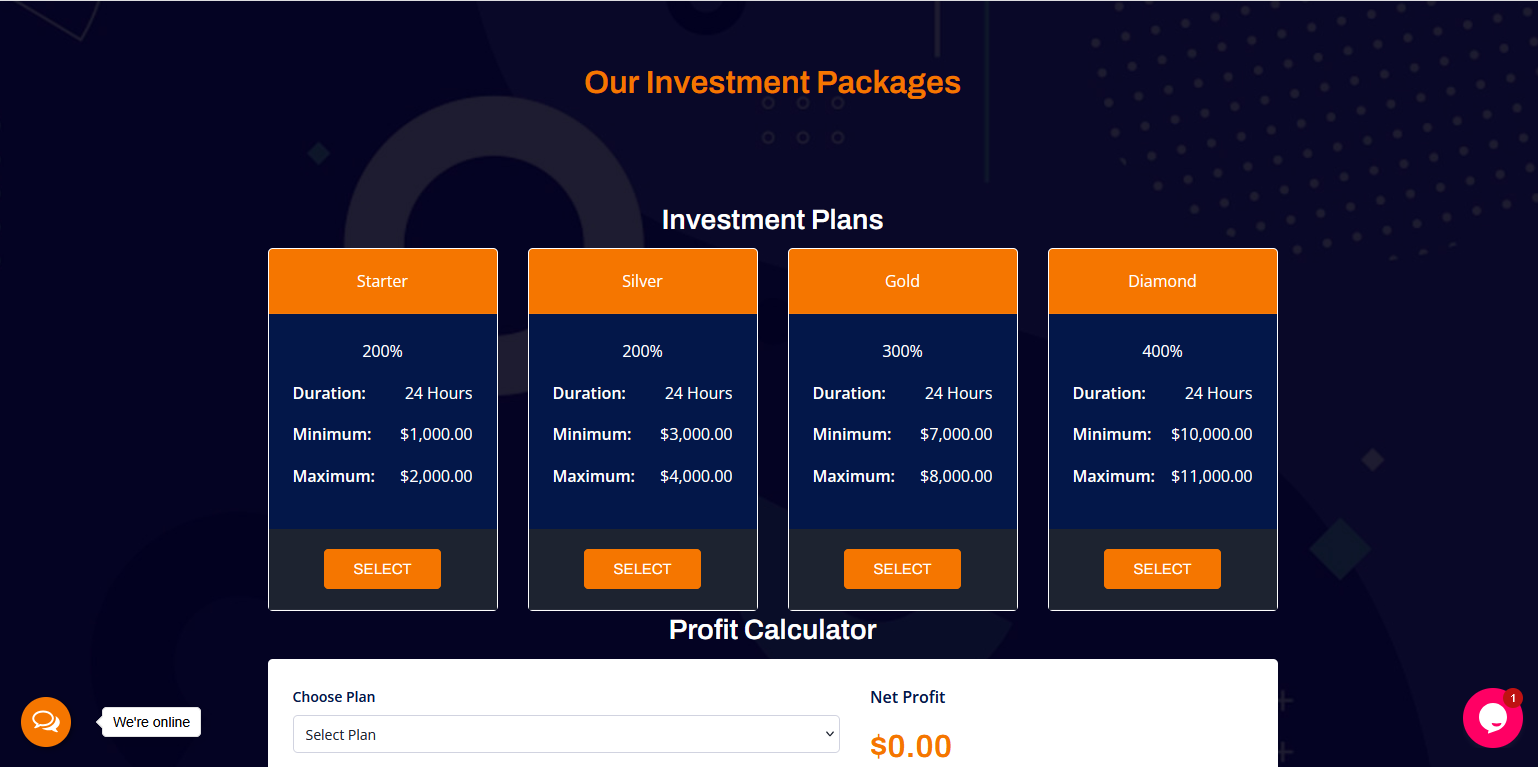

The reported withdrawal and customer experience issues stand out as the most straightforward and concerning sign of a possible scam. The trend of comparable platforms restricting withdrawals or imposing concealed fees is a well-known strategy used by deceptive operations. They frequently permit initial minor withdrawals to establish trust and promote larger investments, only to subsequently freeze accounts or impose excessive, undisclosed fees when investors try to access significant funds. This significantly affects the investor's capacity to access their own funds, turning what once seemed like an investment opportunity into a financial pitfall. The various red flags collectively create a detailed and troubling scenario, strongly recommending against any involvement with this platform.