Review on Tradefx

A Comprehensive Overview of Tradefx.co

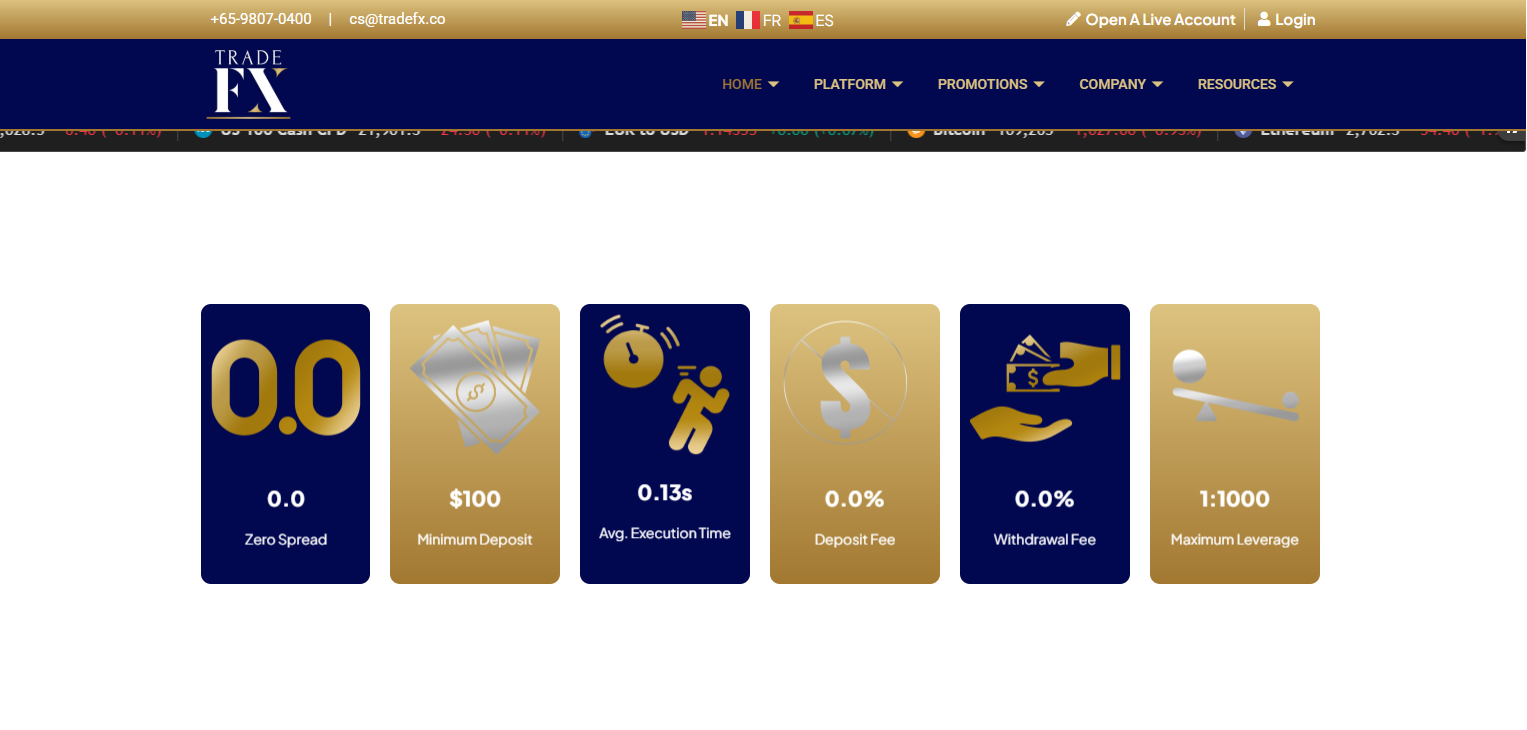

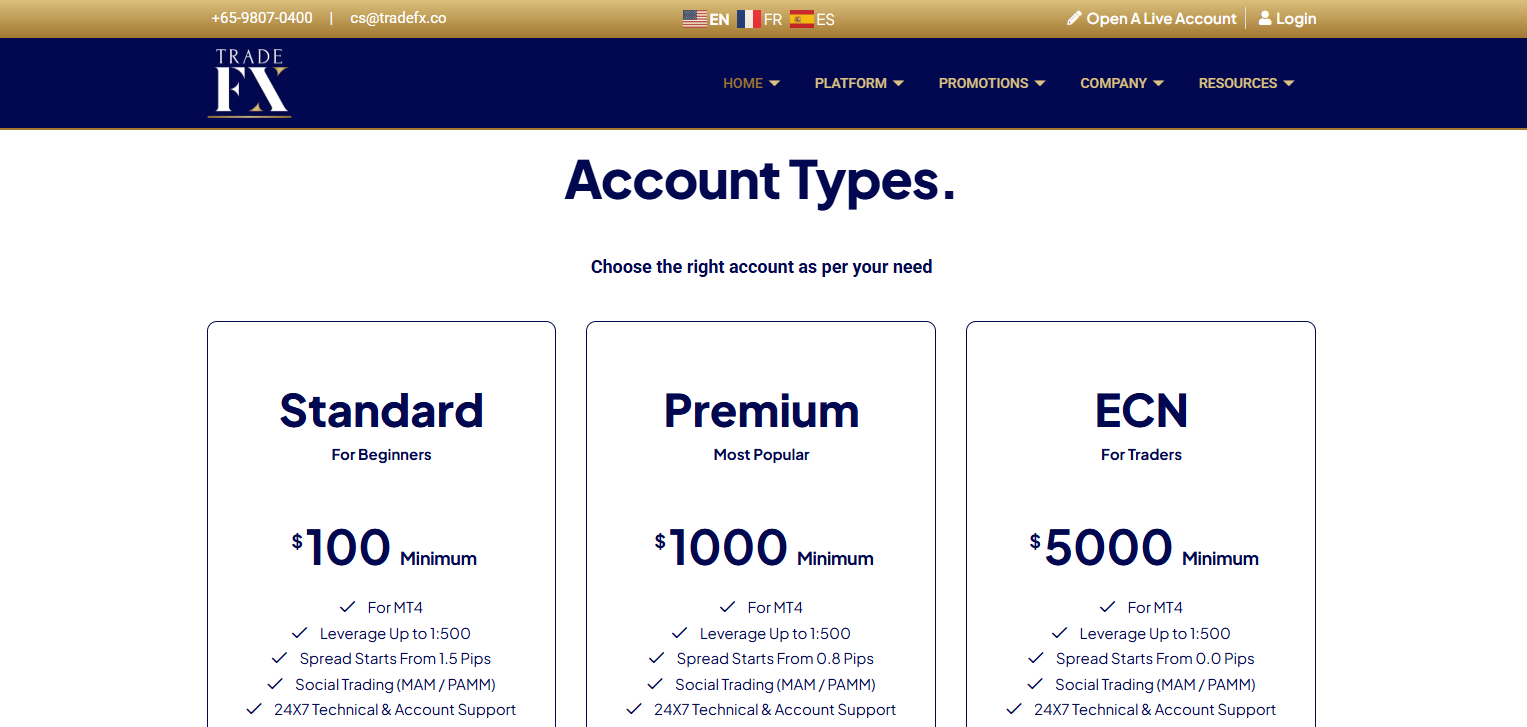

Tradefx.co presents itself as an online forex and CFD brokerage platform, offering users the opportunity to trade in various financial markets including currencies, commodities, indices, metals, and cryptocurrencies. It claims to provide advanced trading tools, multiple account tiers, and compatibility with the MetaTrader 4 platform a popular trading interface among professional traders.

On the surface, Tradefx.co appears to be a legitimate trading environment for both beginners and experienced investors. However, a deeper inspection reveals numerous warning signs that bring the platform’s legitimacy into question. These include unregulated operations, unverifiable company credentials, vague ownership details, and a pattern of customer complaints about account access and fund withdrawals. Despite its polished user interface and persuasive marketing, Tradefx.co may be operating outside the bounds of safe, regulated financial practice.

Notable Keypoints to note on tradefx

Lack of Regulation: Operating without any recognized financial oversight or licensing.

Withdrawal Issues: Multiple reports of users being unable to access their fund

Unverifiable Ownership: No clear ownership structure or public business information.

Deceptive Marketing: Promises of guaranteed profits and low-risk trading common characteristics of scam platforms.

An In-Depth Analysis of Why Tradefx.co Raises Serious Legitimacy Concerns

Tradefx.co markets itself as a modern and versatile forex trading platform, boasting a wide array of services such as currency trading, commodities, indices, metals, and cryptocurrencies. Its homepage and promotional content present an image of professionalism and success, often referencing advanced technologies like the MetaTrader 4 platform and claiming to offer a user-centric experience with tight spreads, fast execution, and attractive bonuses. However, beneath this polished surface lies a troubling lack of foundational elements that define a legitimate and trustworthy financial service provider.

The first and most critical concern with Tradefx.co is its complete lack of regulatory oversight. In the world of forex trading, regulation serves as a baseline standard of trust. Regulated brokers are bound by rules that protect clients' funds, ensure fair trading practices, and enforce operational transparency. These rules typically include client fund segregation, audit requirements, capital adequacy standards, and dispute resolution processes. Tradefx.co fails to provide any evidence of holding a license from a reputable financial authority. There are no registration numbers, no oversight body logos, and no mention of compliance with established financial laws. This absence of regulation should not be taken lightly. Without it, clients have no legal recourse if funds are mishandled or if the company ceases operations without notice.

Equally concerning is the platform’s complete lack of transparency regarding its ownership and operational base. A legitimate broker typically provides verifiable information about its leadership team, corporate history, physical address, and legal structure. This information not only helps to build trust but also allows users to assess the company’s track record and accountability. Tradefx.co provides none of these assurances. There is no clear mention of who owns or operates the platform, no registered business address that can be verified, and no company background information that lends credibility. This anonymity is not a small detail it is a deliberate strategy commonly used by illegitimate platforms to avoid scrutiny and accountability.

Furthermore, one of the most alarming aspects of Tradefx.co's operation is the growing number of complaints regarding difficulties with fund withdrawals. Numerous users report that while making deposits is quick and seamless, attempting to withdraw money becomes an entirely different story. Accounts are often restricted after users request withdrawals, support teams become unresponsive, and delays are frequently justified with vague technical issues or requests for additional verification. In many cases, these users never recover their funds. This pattern of behavior is a classic indicator of a fraudulent trading operation. When a platform makes it easy to deposit funds but imposes unreasonable barriers to withdraw them, it is effectively engaging in unethical if not illegal practices.

The promotional strategies employed by Tradefx.co further reinforce concerns about its legitimacy. The platform aggressively markets high returns with low or no risk, which is a well-known hallmark of investment fraud. All legitimate trading carries risk, and any platform that claims otherwise is misleading its users. Promises of guaranteed profits, minimum risk, and fast financial success are not only irresponsible but also designed to lure inexperienced individuals into depositing their savings without fully understanding the risks involved. Many users fall victim to this marketing trap, only to realize later that the platform does not operate with integrity or transparency.

Another concerning practice involves the high-pressure sales tactics used by Tradefx.co's representatives. Users frequently report receiving constant phone calls and emails encouraging them to deposit more money, often with a sense of urgency. Sales agents may claim that a limited-time opportunity is about to expire or that a sudden market movement is the “perfect chance” to maximize gains. This psychological pressure is a deliberate attempt to push users into making impulsive financial decisions. In some cases, users are even told that failure to deposit more funds could lead to account restrictions or lost trading opportunities. These manipulative tactics exploit emotions rather than supporting sound financial decision-making and are completely inappropriate in any professional trading environment.

Lastly, the lack of legal and technical documentation on the platform is yet another red flag. A professional trading platform should provide clear terms and conditions, privacy policies, risk disclosures, and detailed information about order execution, fees, and margin requirements. These documents help users understand their rights and obligations and are essential for building trust. On Tradefx.co, such documents are either missing, vague, or poorly written, leaving users confused about how the platform actually operates. This lack of clarity not only undermines user confidence but also places traders at significant legal and financial risk.

In conclusion, while Tradefx.co may appear appealing at first glance due to its professional design and wide range of services, a closer examination reveals a troubling array of issues that suggest it is not a legitimate or trustworthy platform. The absence of regulation, lack of company transparency, frequent withdrawal issues, unrealistic profit promises, aggressive marketing tactics, and missing legal documentation all point to a high-risk operation that investors should avoid. For those seeking to participate in forex trading, it is strongly recommended to engage only with licensed brokers who are subject to stringent oversight and who prioritize the safety and transparency of client funds.