Review on Vtmarkets

A Comprehensive Overview of VTMarkets.com

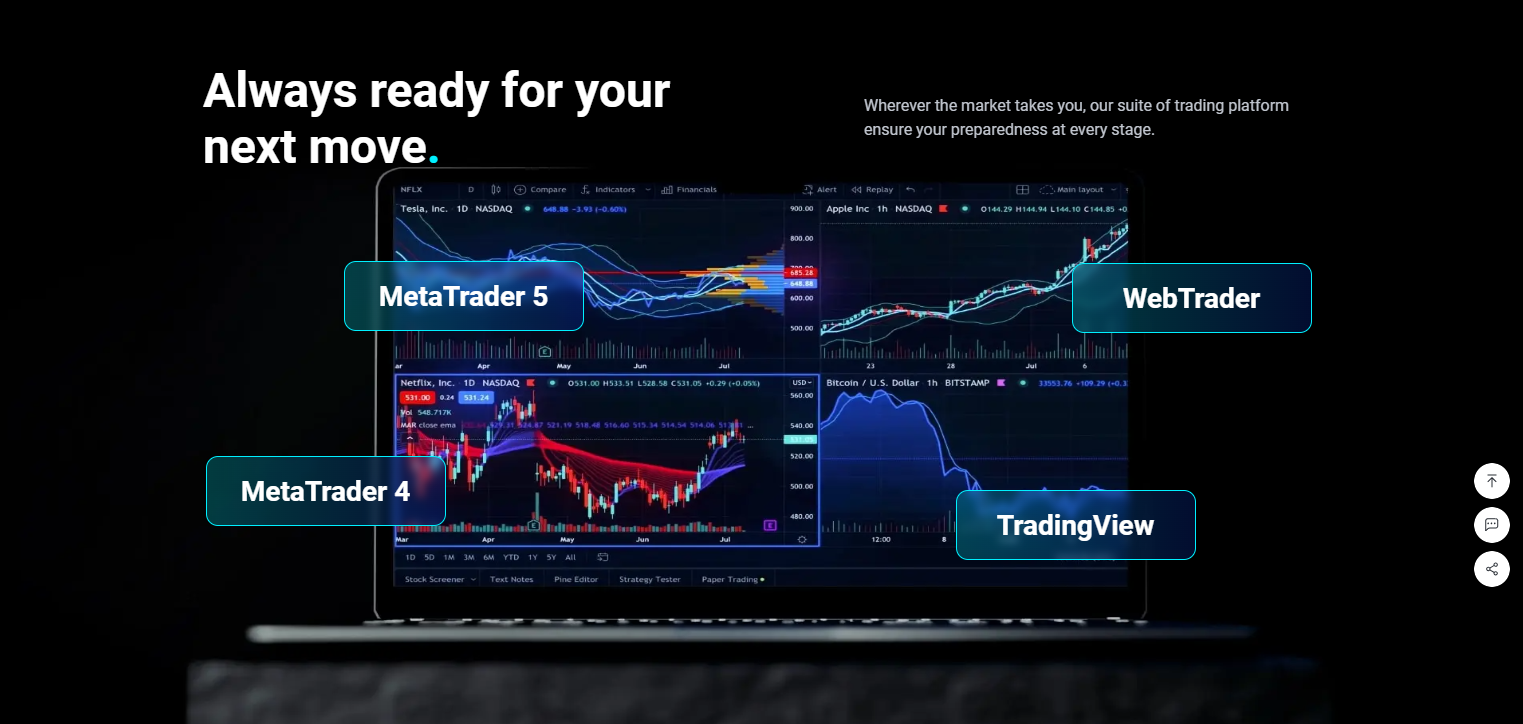

VTMarkets.com is an online forex and CFD broker that claims to offer secure, fast, and transparent access to global markets. Established in 2015, it presents itself as a modern, technologically advanced brokerage firm offering trading services in currencies, commodities, indices, shares, and other financial instruments. The website promotes access to MetaTrader 4 and 5 platforms, mobile trading applications, and features such as tight spreads, fast execution, and advanced risk management tools.

It also advertises multiple account types, including standard and raw ECN accounts, and various promotional offers like deposit bonuses and cashback rebates. These offers are typically designed to attract new clients and encourage higher trading volumes.

VT Markets highlights its registration in several offshore and mid-tier regulatory jurisdictions. However, the lack of registration with top-tier financial authorities like the FCA (UK) or the SEC (USA) raises important concerns regarding investor protection and dispute resolution mechanisms.

Despite offering a professional-looking platform and a broad range of services, there have been increasing allegations and online reports from users claiming unfair practices, especially around fund withdrawals, poor customer support, and suspicious account closures. This casts doubt on the reliability and legitimacy of the broker, particularly for retail traders.

Notable Keypoints to note on vtmarkets

Lack of regulation by any top-tier financial authority.

Numerous customer complaints related to withdrawal and account handling

Use of aggressive bonus and promotional schemes with unclear terms.

Limited transparency on corporate structure and legal protection.

A Detailed Analysis of Why VT Markets is Considered Risky

VT Markets presents itself as a modern, global trading platform designed to serve clients in the retail and institutional segments of the financial market. The website showcases a sophisticated interface and a broad selection of assets, including forex, commodities, indices, and shares, all accessible via well-known trading platforms like MetaTrader 4 and MetaTrader 5. On the surface, this broker appears to be a legitimate operation, offering competitive spreads, low latency, and leverage that appeals to traders looking for flexibility. However, beneath this polished appearance lie numerous concerns that raise significant doubts about the firm’s integrity and reliability.

One of the foremost issues with VT Markets is the nature of its regulatory status. Although the platform may be registered with certain oversight bodies in offshore or mid-tier jurisdictions, it lacks licensing from the most reputable and strictly governed financial authorities in the world. This is a red flag for many experienced traders because registration in less-stringent jurisdictions often translates into minimal enforcement of compliance standards and limited recourse in the event of a dispute. Without strong regulatory protections, traders are effectively placing their trust in a broker that is not held to the same standards as those operating under more stringent financial regulations.

Additionally, transparency is a major concern. The website offers little verifiable information about the individuals or corporate entities managing the brokerage. This lack of openness makes it difficult for clients to assess the credibility of those behind the operation. In the financial services industry, transparency about ownership, executive leadership, and regulatory reporting is a key factor that instills trust and confidence among investors. The absence of such transparency can lead to serious concerns about accountability, especially when it comes to managing client funds and resolving complaints.

Another area of concern is the firm's use of promotional schemes and trading bonuses. While such offers may appear attractive at first glance especially to newer traders these bonuses often come with restrictive terms and conditions that are not always disclosed in a clear or straightforward manner. Traders may find that accepting a bonus ties up their deposited funds under complicated requirements, such as reaching high trading volumes before becoming eligible to withdraw profits. These kinds of limitations can trap users in unfavorable trading environments and significantly delay their access to their own capital.

User experience, based on public complaints and discussions within trading communities, further complicates VT Markets’ credibility. A substantial number of individuals have reported difficulties related to withdrawing funds from their accounts. These issues range from unexplained delays to outright denial of withdrawals. Some users also describe sudden account closures, particularly after profitable trades, without clear justification or communication from the broker. Such incidents suggest a pattern of behavior that prioritizes the broker’s financial interest over fair client treatment. In many legitimate brokerage operations, the withdrawal process is smooth and transparent, with clear timelines and customer support available to address issues promptly. When a broker frequently fails to deliver on these basics, it becomes difficult to view them as a trustworthy service provider.

Moreover, the customer service component of VT Markets appears to be lacking based on several user experiences. Traders have reported unresponsive or slow customer support, with unresolved tickets and limited help when it matters most. A reliable broker should provide easily accessible support, especially when handling technical issues or urgent financial transactions. When users cannot get timely assistance for problems affecting their funds or accounts, this casts doubt on the broker's professionalism and operational structure.

Adding to the concern is the lack of detailed documentation about key trading policies. Terms related to order execution, margin calls, slippage, and account maintenance are often written in overly generic language or buried in complex terms of service documents. This makes it difficult for users especially those who are not deeply familiar with financial legalities to fully understand their rights and obligations. In a fair and transparent trading environment, these policies should be laid out in simple, unambiguous terms to protect both the broker and the client from misunderstandings.

In terms of risk, VT Markets offers high leverage options that can be attractive to experienced traders but dangerous for beginners. While leverage can magnify profits, it also increases the potential for substantial losses. Brokers offering high leverage without proper risk warnings or mandatory education are often criticized for encouraging reckless trading behavior. This suggests that VT Markets may prioritize trading volume over client success, which further aligns with the profile of brokers that operate with questionable ethics.

Taken together, these elements build a picture of a brokerage that, while functional on the surface, contains several high-risk features that should not be ignored. The attractive design, platform compatibility, and range of instruments cannot compensate for the underlying weaknesses in regulatory protection, transparency, customer support, and ethical practices. For traders considering opening an account, it is essential to weigh the short-term appeal of bonuses and leverage against the long-term risk of potentially losing access to funds or encountering unfair trading conditions.

While not conclusively fraudulent in every sense, VT Markets demonstrates enough red flags to warrant serious caution. Experienced traders may recognize these warning signs and proceed carefully or avoid the platform altogether. Inexperienced traders, however, may fall prey to misleading advertising and overly optimistic promotional language, only to face difficulties when attempting to withdraw profits or challenge irregular account behavior.

Ultimately, the key issue with VT Markets is not that it lacks features or offers poor market access it is that the structural integrity and ethical foundation of the company are questionable. In an industry where trust is paramount, these concerns cannot be overlooked. Traders should consider more transparently regulated and well-established brokers to protect their investments and trading experience.